portability estate tax deadline

In other words for DSUE portability to be claimed the executor must elect portability on the deceased spouses estate tax return. If the executor timely files the decedents Form 706 United States Estate and Generation-Skipping Transfer Tax Return which generally is due nine months after the.

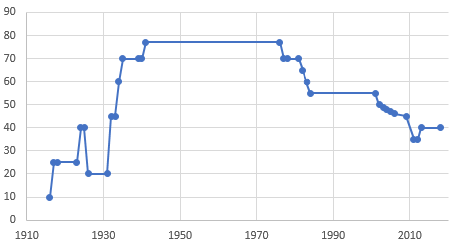

Estate Tax In The United States Wikiwand

US Estate Tax.

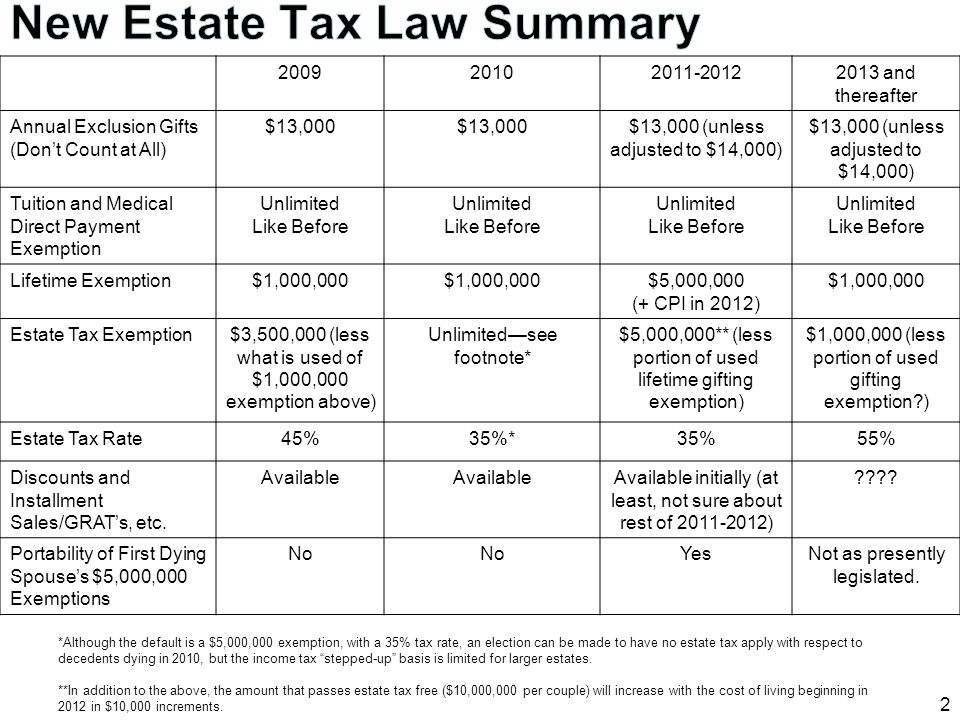

. The Tax Relief Unemployment Insurance Reauthorization and Job Creations Act of 2010 introduced for the first time the concept of portability of the federal estate tax exclusion between spouses. Originally published in Canadian Tax Highlights Volume 25 Number 7 July 2017. Simple Step-By-Step Instructions Make It Easy To File Taxes Online With Confidence.

The estate tax exemption ie. Earlier relief for late returns was granted but only through December 31 2013. Thus the estate tax rate is 40 and Doras estate is still worth 20 million.

The deadline to file an application for portability is March 1. 2017-34 2017-26 IRB which provides a more liberal timeframe for certain estates to make the federal. Important points to consider when filing for Portability.

To secure these benefits however the deceased spouses executor must have made a portability election on a timely filed estate tax return. To transfer your assessment difference you must have established a new homestead on or before January 1 of the third year after abandoning your previous homestead. If the deadline to file has passed can I still file for portability.

Under previous guidance an estate had to elect portability within 9 months of the date of death on a timely filed estate tax return even if the executor was not otherwise. Instead of an estate tax closing letter the executor of the estate may request an account transcript which reflects transactions including the acceptance of Form 706 and the completion of an examination. When enacted it was meant to apply only to estates of.

However an automatic six-month extension can be. Any portion not used by the first spouse to die may via. The due date for filing an estate tax return is nine months after the date of death with an automatic six month extension if requested by the nine month due date.

As unlike the normal option for a 6-month. However the IRS just issued Revenue Procedure 2014-18 which allows eligible estates an extension through December 31 2014. What is the deadline to file.

Phils 1158 million estate tax exemption was unused and Dora cannot claim the exemption without portability so Dora can only use her exemption of 1158 million when she passes away. To transfer the estate tax exemption form 706 must be filed including the portability election within 9 months of the date of the first spouses death. Ad Dont Wait Until The Deadline To Get Your Biggest Refund.

Letss assume the estate tax exemption is still 114 million when Dora dies. The IRS thankfully has made electing portability easy. You can also file for a 6-month extension.

To allow time for processing please wait at least 9 months after filing Form 706 to request a closing letter. The amount you can transfer at death without incurring a federal estate tax has fluctuated widely over the years. Form 706 is due on or before nine months after the deceased spouses date of death.

Each year the government sets a tax exemption limit or exclusion amount for estates under a. New Extended Deadlines for Portability Election Filing. If the estate representative did not file an estate tax return within nine months after the decedents date of death or within fifteen months of the decedents date of death if a six month extension of time for filing the estate tax return had been obtained the availability of an extension of time to elect portability of the DSUE amount depends on whether the estate has a filing requirement.

For a surviving spouse to properly make the election to use the deceased spouses unused estate tax exemption the surviving spouse must timely file IRS Form 706 United States Estate and Generation-Skipping Transfer Tax Return. The IRS has granted an extension of time only until December 31 2014 to elect portability of the unused estate tax. Why You May Want to Transfer Your Unused Estate Tax Exemption to Your Spouse December 17 2019 by Cathy Lorenz.

The portability provisions of the Tax Relief Act allow a surviving spouse to use the unused exemption from his or her deceased spouse to transfer property during life or at death free from federal estate tax. Beyond the unique opportunity that Revenue Procedure 2017-34 creates for couples where one spouse already passed away the good news of the new rules is that it effectively turns what is normally a 9-month deadline to file a Form 706 estate tax return just to claim portability into a 2-year deadline instead. The return is due nine months after death with a six-month extension option.

Electing to use estate tax portability makes a significant difference in your federal estate tax liability. Finish Your Taxes In Minutes. That exclusion amount is port- able between spouses.

US estate tax is imposed if a US citizen or residents taxable estate exceeds 549 million. June 10 2014. Estate tax planning was changed forever with the enactment of estate tax portability in 2011.

By Cynthia Carlson and Evan R. The portability election must be filed on a Form 706 by the the date a normal federal estate tax return must be filed 9 months after the date of death or 15 months with an automatic 6 month extension However taxpayers who do not have taxable estates currently under 5490 million may forget to file such a return to elect portability. For example in 2004 it was 15M 3M for married couples which many middle class families needed to take seriously when they considered assets such as retirement and life insurance.

Kaufman Those who have been involved with an estate of a decedent who died in 2011 2012 or 2013 should be aware of an important upcoming deadline. The deadline to file a Form 706 is nine months after death with an automatic six month extension available. Click Avoiding malpractice under the new estate tax portability rules published article and Fun with Estate Tax Portability seminar outline to read my recent article on this topic published by the Illinois State Bar Association in its Trusts and Estates newsletter.

The federal Estate Tax commonly referred to as the death tax is a tax on a persons right to transfer property upon their death. On June 9 the IRS issued Rev.

Should You Elect The Alternate Valuation Date For Estate Tax

New Irs Requirements To Request Estate Closing Letter

Why Everyone Needs An Estate Plan Legacy Design Strategies An Estate And Business Planning Law Firm

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Distributable Net Income Tax Rules For Bypass Trusts

House Democrats Seek Return Of A Tougher Estate Tax Don T Mess With Taxes

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

This Is Another In A Series Of Blogs On The Basics Of Estate Planning Estate Planning Attorneys Do Many Th Estate Planning Estate Planning Attorney Estate Tax

How Much Tax Do You Pay On Inheritance Legacy Design Strategies An Estate And Business Planning Law Firm

Form 706 Extension For Portability Under Rev Proc 2017 34

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Estate Tax In The United States Wikiwand

Form 706 Extension For Portability Under Rev Proc 2017 34